The Island County Assessor’s Office is alerting the public to new state law aimed at easing property taxes for vulnerable populations.

The 2023 Legislature passed Substitute House Bill 1355, which makes changes to the property tax exemption and deferral programs for senior citizens, persons with disabilities and disabled veterans.

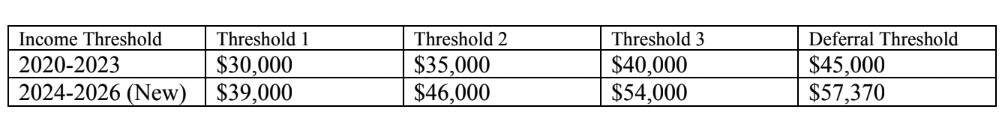

These changes increase the income thresholds to qualify for the program, adjust the frequency for determining income thresholds from every five years to every three years and assure that those who received a cost-of-living adjustment in calendar year 2023 will remain eligible for the 2024 exemption if they would have otherwise been disqualified, the assessor’s office noted.

“This was a bi-partisan bill unanimously approved by our state legislature in both Houses and supported by the Washington State Association of Assessors,” Island County Assessor Kelly Mauck said. “This bill will be instrumental in easing the burden on our seniors and disabled property owners by reducing their tax bill during a period where we are experiencing high inflation, allowing them to stay in their homes and maintain their quality of life.”

If you are already in this tax relief program, it will be automatically adjusted, and you will receive a letter from the assessor’s office. New applicants will be eligible to apply starting in 2024 based on their 2023 income.

Additional updates and information will soon be found on the Island County Assessors website, islandcountywa.gov/158/Assessor, or residents may call the office at 360-678-7853.